When it comes to Sustainability terminologies, these three terms get used a lot.

But while these terms may appear interchangeable, there are subtle yet significant distinctions you’ll want to know if you want to align with the ever-growing movement toward socially and environmentally responsible business practices.

And if you’re not currently planning on it, you might want to reconsider because it’s clearly a movement worth joining.

Environmental and social issues are now firmly on the boardroom table.

Take climate change. The ratio of the world’s largest publicly-traded companies with net-zero targets now stands at 33%. Meanwhile, the global GDP captured by government net zero targets stands at 91%, a 68% increase over 2020.

The rate of acceleration can give you whiplash. When R&G was founded in 2016, the clarion call to net zero had yet to sound.

I was recently on a call with a high-profile tech consultant to Fortune 500 companies who were surprised to discover that ESG structures in compensation plans for the executives he was working closely with “had actual teeth.”

In fact, he’s right, compensation plans with ESG mentions rose by 13% to 70% in 2022, with carbon footprint management and diversity and inclusion targets growing the fastest.

So how do you make sense of all this? It’s best to start with the fundamentals.

Read on for our explanation of the core differences between CSR, ESG and Sustainability and what it means for your business.

Getting clear on Sustainability terminologies–and why it matters

You may be thinking to yourself, “Are they really any different? This Sustainability terminology all seems like semantic nonsense.”

The truth is, you wouldn’t be entirely wrong. Generally speaking, in a business environment, ESG vs CSR vs Sustainability are all similar colours on the same ideological spectrum. They all circle around a company’s impact on, and relationship with, the world around it.

Whether we’re talking about a company’s carbon emissions, business ethics, community involvement, or its willingness to share information on those impacts and relationships, in many ways, we can refer to these topics as Sustainability, ESG reporting, or CSR.

But when we start getting more specific, there are nuanced differences between the three.

And when it comes to reporting information to investors, attracting the burgeoning market of conscious consumers, or planning to meet new regulatory requirements — understanding the difference can be important.

So now I know you’re curious: what is the difference between them? Here’s our detailed breakdown.

First off, let’s talk about Sustainability

Unlike ESG or CSR, Sustainability is, at its core, really a state of being. It’s a mindset that holistically encompasses how a company chooses to operate.

A completely sustainable company would only ever use resources as quickly as they are able to replace them, whether we’re talking about natural resources, human resources, or financial resources.

To do this effectively, companies typically incorporate Sustainability considerations into every aspect of their business.

They might switch to renewable energy, change product design and manufacturing processes to minimize waste, make financial decisions considering longevity over quarterly profits, avoid employee turnover with fair treatment and pay, or ensure they have long-standing community support through engagement and investment.

Sustainability should be integrated into a business’s model in such a way that it becomes a central aspect of the business rather than just an add-on or afterthought. Because of this, it’s become synonymous with impact.

It helps to consider what an ecologically and socially unsustainable company looks like.

Take a logging company searching for new forests to cut down as an example — if your extraction practices don’t involve replanting, replenishing and returning to the same locations, you’ll eventually run out of trees to cut down, which would be bad for the environment and your balance sheet.

Where exploitation of resources isn’t just bad for the planet, it’s shooting yourself in the foot.

Sustainability isn’t just financial. It’s about operating in balance, where your economic growth is powered by practices that minimize the environmental and social cost of doing business.

What about how to measure Sustainability? That’s where ESG comes in

Because Sustainability is so holistic in nature, it’s become a catch-all term.

Enter ESG, an acronym that Sustainability Practitioners and investors specifically use as a measure of business performance. The term itself refers to the three major brackets considered when assessing the Sustainability pressures and potential to outperform competitors: Environmental, Social, and Governance.

ESG and Sustainability reporting

Since ESG is really just talking about how to measure Sustainability, as opposed to being a needs-based approach, we typically see the term most frequently used when it comes to Sustainability reporting.

That’s also why ESG is often associated with risk management and corporate disclosures tailored to the investor community. Strong environmental, social, and governance Sustainability performance is directly tied to solid risk management.

If a company causes an environmental disaster, like an oil spill, for instance, they’re not only causing harm to the environment. They’re also creating a costly conundrum for its investors through government fines, hurt reputation, and lowered stock prices.

When it comes to ESG, not having strong oversight and environmental policies becomes serious business. Companies choose to disclose their ESG performance in the form of annual Sustainability reports to better attract investors.

But we’ll get into corporate disclosures more later. There’s still one more term to cover.

CSR and Sustainability

CSR or Corporate Social Responsibility can be thought of as community-centric.

You hear it most when organizations refer to their initiatives that support the social and environmental well-being of the communities where they operate.

The big difference between CSR and Sustainability is that CSR only encompasses the initiatives companies take on to benefit certain stakeholder groups — and those initiatives are typically done entirely outside of changing their day-to-day operations for the better.

So what does this look like in practice?

Stick with me here, but take cigarettes as an example. We all know smoking tobacco can lead to cancer — even the companies who sell tobacco know this all too well.

Think about a cigarette maker donating to a charity dedicated to cancer treatment and research. Ultimately, that’s not an attempt to make tobacco less cancer-causing and more sustainable, as it’s not working to eliminate the cancer-causing effects of the product.

But in this example, there’s at least a responsible effort to offset some of the prospective impact and cost of cigarette smoking on society by taking the initiative outside the core business model.

Now consider if that company were thinking holistically about Sustainability, however. They might instead invest those funds into research to eliminate the cancer-causing effects of the product, which would improve their reputation, benefit one of their key stakeholder groups (their customer), and ensure their customer base lives on to keep buying their products as a result. Now that would be true Sustainability, not just CSR.

A shift in Sustainability terminologies: From CSR to ESG

If you’re thinking, “Corporate Sustainability sounds like a much more beneficial approach,” you would be right, which is why CSR is quickly becoming an outdated term. Many organizations attempt to evolve from CSR to ESG and/or Sustainability.

In reality, Sustainability amounts to much more than CSR.

So why don’t more companies do it? You may have noticed from the previous example that retooling your business to be genuinely sustainable takes more than just a change in terminology; it requires a total transformation of your business model. But it’s certainly possible.

Take Interface, for example

When it comes to Sustainability, precious few moments of true lightning have struck in the business world — but if there’s one, it was when former CEO of the modular carpet maker Interface, Ray C. Anderson, picked up a copy of the book, The Ecology of Commerce by Paul Hawken.

According to Ray’s memoir Confessions of a Radical Industrialist, the book’s call to action was an epiphany.

While the book challenges traditional industrial models by presenting a vision for a more sustainable approach to business, Anderson credits it with opening his eyes to the destructive impact of industrial practices on the environment, inspiring him to take responsibility for the impact of his own company.

In fact, ‘taking responsibility’ might be an understatement.

Ray set about doing nothing short of planning a wholesale transformation of Interface from top to bottom, completely rethinking its approach to product design, manufacturing, and waste management.

Ray’s vision and leadership sparked a culture shift within the company that endures today. Interface successfully achieved its own lofty goal to have zero negative impact on the planet by the year 2020 (or Mission Zero®), and now has its sights on mitigating climate change with products that provide new and innovative emissions reduction solutions in a carbon-constrained world.

We’d never call what Ray accomplished CSR. As far as Sustainability terminology is concerned, Interface’s story takes transformative change for a more sustainable world to a new level.

Sustainability and transparency: When does ESG reporting come in?

With increasing demands for companies to act more sustainably, many are now disclosing their Sustainability efforts or ESG performance in annual reports. You might see them be called ESG reports, Sustainability reports, or CSR reports — all varying degrees of the same attempt to be transparent about their impact and how they’re measuring Sustainability for their organization.

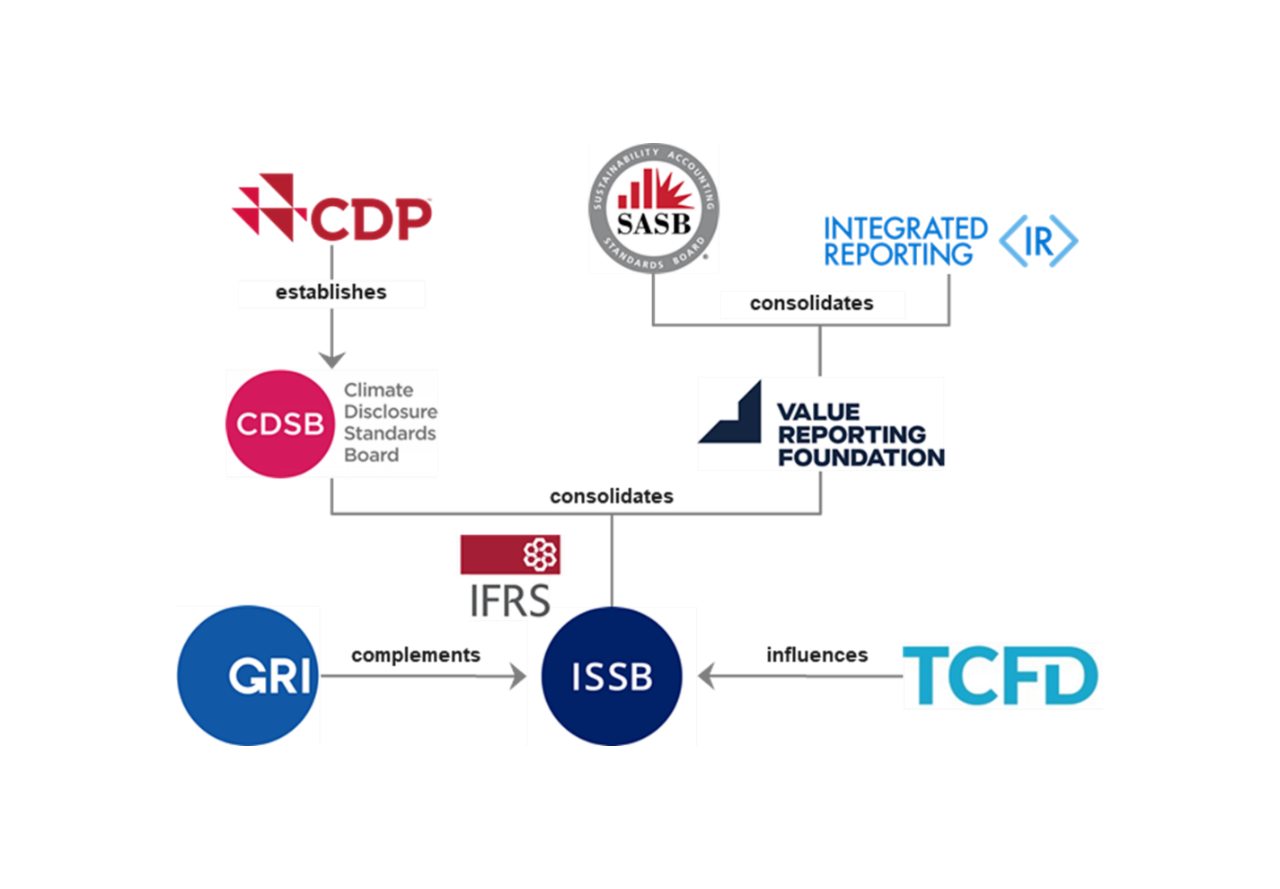

Because there are so many variations, there aren’t always uniform metrics to compare companies’ Sustainability performance. Some organizations worked to create universal standards so stakeholders who are interested in this information can compare Sustainability reports across peer groups or even across industries.

Picture an investor analyst weighing whether to advise her clients to invest in one green hydrogen project or another, or add one low carbon transformation commodity brand name to their portfolio over another — what would differentiate these purpose-led companies? An ESG report on their impact would help, and standards make it easy to find identically formatted data disclosures to make the comparison.

You may have heard of some of these standards already.

The Global Reporting Initiative (GRI), the International Financial Reporting Standards Foundation (home of the Sustainability Accounting Standards Board, or SASB), and the Task Force on Climate-Related Financial Disclosures (TCFD) are a few at the top of the reporting agenda for many mature reporters.

Investors aren’t the only ones using these frameworks to decide which company will be a smart financial investment. Governments are also using them to better track regulatory compliance.

One of our largescale mining and materials clients recently relayed an anecdote about their chance encounter with a graduate student at a coffee shop who coincidentally had the company’s Sustainability report pulled up on their laptop screen — let that be a lesson to you that your talent and recruitment strategy might be more related to your ESG reporting practice than you might realize.

For more information on reporting frameworks and understanding if an annual Sustainability report is right for you, contact one of our Sustainability experts.

Where do we go from here?

We hope you’ll take two lessons away from this post:

- ESG vs CSR vs Sustainability — though it can seem like a subtle nuance in the grand scheme of things, there is a difference, and the little details can matter when it comes to the major impact a company can have on society and the planet — and your stakeholders’ impressions of that impact.

- Transparent disclosure of a company’s Sustainability, ESG or CSR performance, both good and bad, can be a valuable tool for determining which companies are putting their money where their mouths are on Sustainability and where we should be putting our money and faith as investors, consumers and community members.

Want Sustainability to feel even less complicated? Let us help tell your story.

Our award-winning strategists and Sustainability consultants are dedicated to helping businesses like yours make a difference. We understand that Sustainability isn’t just about being environmentally friendly–it’s about creating meaningful and authentic connections with your stakeholders.

That’s why we provide comprehensive and reliable Sustainability and ESG reporting and storytelling that accurately measures and communicates your environmental, social, and governance practices. Our expertise allows you to meet stakeholder demands for transparency and Sustainability, and gain a competitive edge in the market.

Book a free consultation with us today to learn more about how we can help you achieve your Sustainability goals.