Your stakeholders and investors are increasingly demanding greater transparency and accountability when it comes to your ESG practices—meaning a well-crafted ESG report is essential.

Your report should combine compelling storytelling with easy-to-digest performance metrics to effectively showcase your organization’s progress and efforts toward sustainability and responsible management.

And if you want to create an effective ESG report, you’re in luck! We’re diving into the importance of ESG reporting and offering guidance on the elements that go into creating an impactful report with 10 expert tips.

With our help, you’ll be well on your way to creating a report that truly resonates with your stakeholders and demonstrates your commitment to ESG practices. Whether you’re about to write your first report—or you’re a seasoned reporter, there’s an insight to fit into the toolkit of Sustainability Managers and Communications Specialists of all stripes on this list, so read on.

But first, what is ESG reporting, and why does it matter?

ESG reporting involves documenting and communicating an organization’s ESG progress and performance. The ESG metrics used in reporting aim to provide information on the sustainability, risks, and ESG-related opportunities associated with an organization. This type of reporting has become increasingly crucial as investors and stakeholders demand increased transparency and accountability in ESG practices.

The importance of ESG reporting has skyrocketed in recent years, driven by the growing demand for increased transparency and accountability in ESG practices from investors and stakeholders. A well-crafted ESG report can help organizations foster stakeholder trust, enhance their reputation, and create business value. It also provides valuable insights into areas for improvement and enables informed decision-making on ESG strategies.

10 Tips for Effective ESG Report Design

Designing an effective ESG report can be a daunting task. To help you get started, here are the top 10 tips for ESG report design:

Tip #1: Know Your Stakeholder Audiences

Before you start crafting your ESG report, it’s essential to understand who your audiences are. Your report should be tailored to audiences’ needs, preferences, and expectations. Your report should be clear, concise, and easy to understand for your target stakeholders, whether it’s investor analysts or the wider public.

Example: Patagonia

Patagonia’s ESG report is tailored to its audience of eco-conscious consumers and addresses the environmental and social impact of the company’s operations and products. The report is easy to navigate and provides information on the company’s sustainability initiatives, environmental footprint, and social responsibility.

Tip #2: Define Your ESG Storytelling Strategy

Having a clear ESG storytelling strategy is crucial for effective ESG reporting. Your narrative, structure, and chosen communications challenges should highlight your company’s approach to ESG, including your commitments, programming and progress. Your ESG storytelling strategy should flow from your overall business strategy and be regularly reviewed and updated.

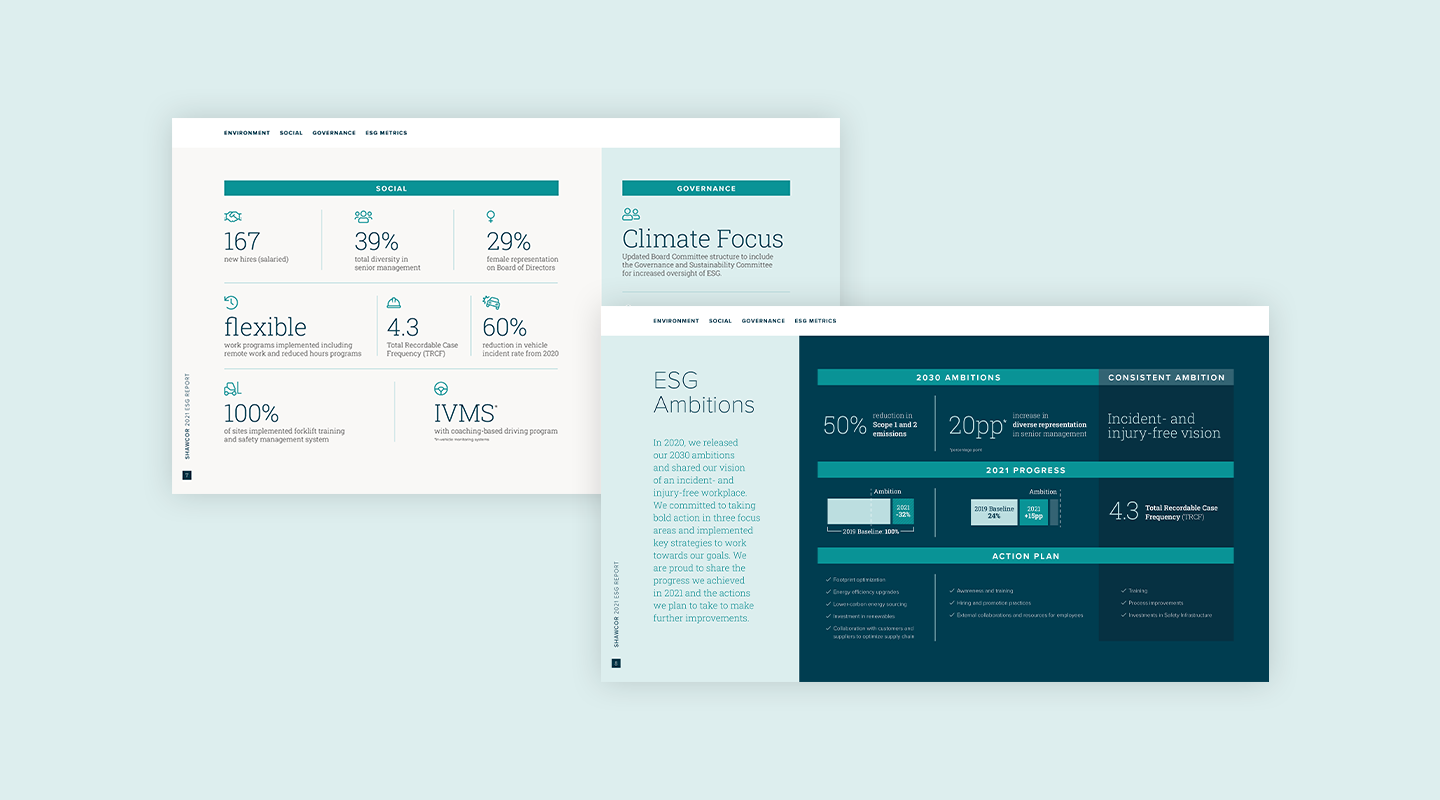

Example: Shawcor

Shawcor, a global energy services company, has defined its ESG storytelling strategy through its commitment to sustainability and environmental responsibility.

The company has set clear sustainability goals and objectives and integrated them into its business operations and decision-making processes. Shawcor also regularly assesses its ESG performance and sets targets to continuously improve its sustainability performance. The company’s ESG storytelling includes initiatives such as reducing greenhouse gas emissions, promoting sustainable procurement practices, and implementing waste reduction programs. Through its defined ESG storytelling strategy, Shawcor demonstrates its commitment to sustainability and provides stakeholders with a clear understanding of its approach to ESG.

Tip #3: Use Interactivity, Infographics and Visual Aids

With so much information available, it can be a challenge to present complex ESG data in a way that’s easy for readers to understand and engage with. Fortunately, using interactivity, infographics, and other visual aids can help simplify complex information and make your report more engaging for readers. With compelling user experiences designed in digital formats such as web apps or microsites, you can bring your ESG journey to life and help your audience feel and interact with your progress rather than simply reading it.

To create effective visual aids, consider using flow charts, graphs, scrolling imagery, or any other visual device showcasing ESG data and results. For instance, you could use a pie chart to show the breakdown of a company’s carbon emissions or a bar graph to compare the sustainability practices of different companies. When creating visual aids, it’s essential to use labels and captions that clearly explain what the data is representing, so readers can easily understand the information being presented.

Example: Unilever

Unilever’s ESG report is filled with infographics, charts, and diagrams. They help to convey the company’s sustainability initiatives and ESG performance in an easy-to-understand manner. The report also includes interactive elements, such as links to videos and additional resources, to give readers a more in-depth look at the company’s ESG efforts.

Tip #4: Activate Key ESG Issues

There are a variety of ESG issues that companies can focus on in their reports. As you define those material issues for your company and industry through your materiality assessment, it’s essential to keep a lens on how you will use them to inform your communications and storytelling. You can keep your ESG communications concise by assigning each issue with a key message for each stakeholder audience. Then, organize messages to fit the appropriate communications channels to ensure you provide the most relevant information to your stakeholders.

Most importantly, keep an eye on ensuring these issues are easy to find and search — so your stakeholders can jump straight to the issues that matter most to them.

Example: Supima

Supima, a cotton supplier based in California, focuses on key ESG issues in its reporting. Supima is a member-owned cooperative, and its ESG report focuses on the sustainability of its cotton farming operations.

The report highlights the company’s efforts to promote water conservation, reduce pesticide use, and promote fair labour practices. Supima also provides detailed information on its supply chain management, including its commitment to traceability and transparency. By focusing on the specific ESG issues most relevant to its operations, Supima demonstrates its commitment to sustainability and responsible business practices.

The company’s ESG report is a clear and concise representation of its focus on key ESG issues and provides stakeholders with a clear understanding of its sustainability efforts.

Tip #5: Use Consistent Formatting

To ensure your ESG report is accessible and user-friendly, it’s crucial to maintain a consistent formatting style. This means using a consistent font and font size throughout the report, incorporating headings and subheadings to break up lengthy sections, and leveraging bullet points or tables to organize information clearly and concisely. By implementing these design strategies, your report will be more digestible and reader-friendly, ultimately increasing engagement and comprehension among your stakeholders.

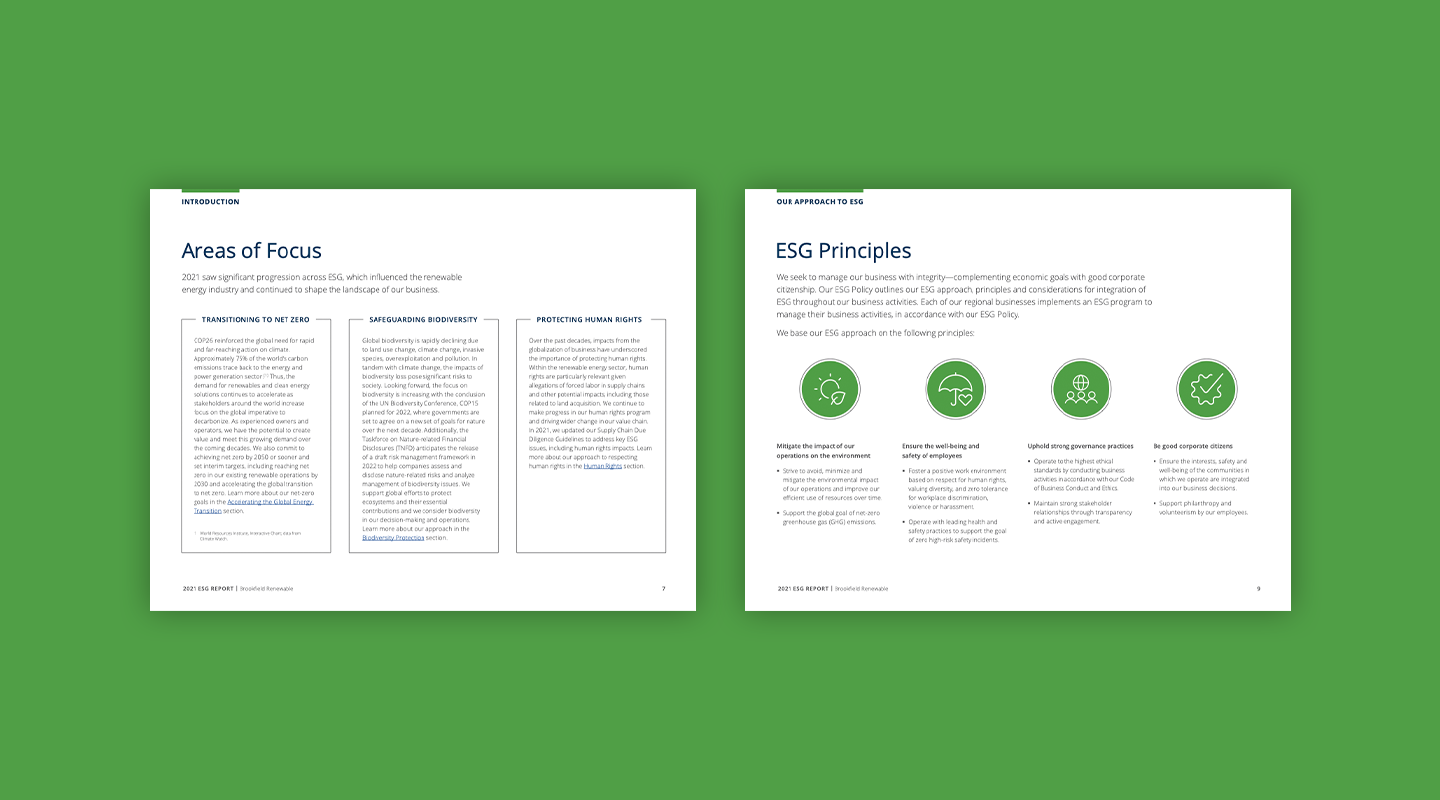

Example: Brookfield Renewable

In their latest ESG report, Brookfield Renewable uses a clean and organized layout, and consistent type hierarchy throughout the document. They also use clear headings and subheadings to break up the content and make it easy to navigate, and utilize tables and charts to present their ESG performance data. This approach helps ensure their stakeholders can quickly understand the critical information and performance metrics presented in their ESG report.

Tip #6: Highlight Progress and Achievements

Your ESG report is an opportunity to showcase your company’s progress and ESG achievements. Be sure to highlight any specific initiatives or programs you’ve implemented, as well as any notable improvements or achievements in these areas.

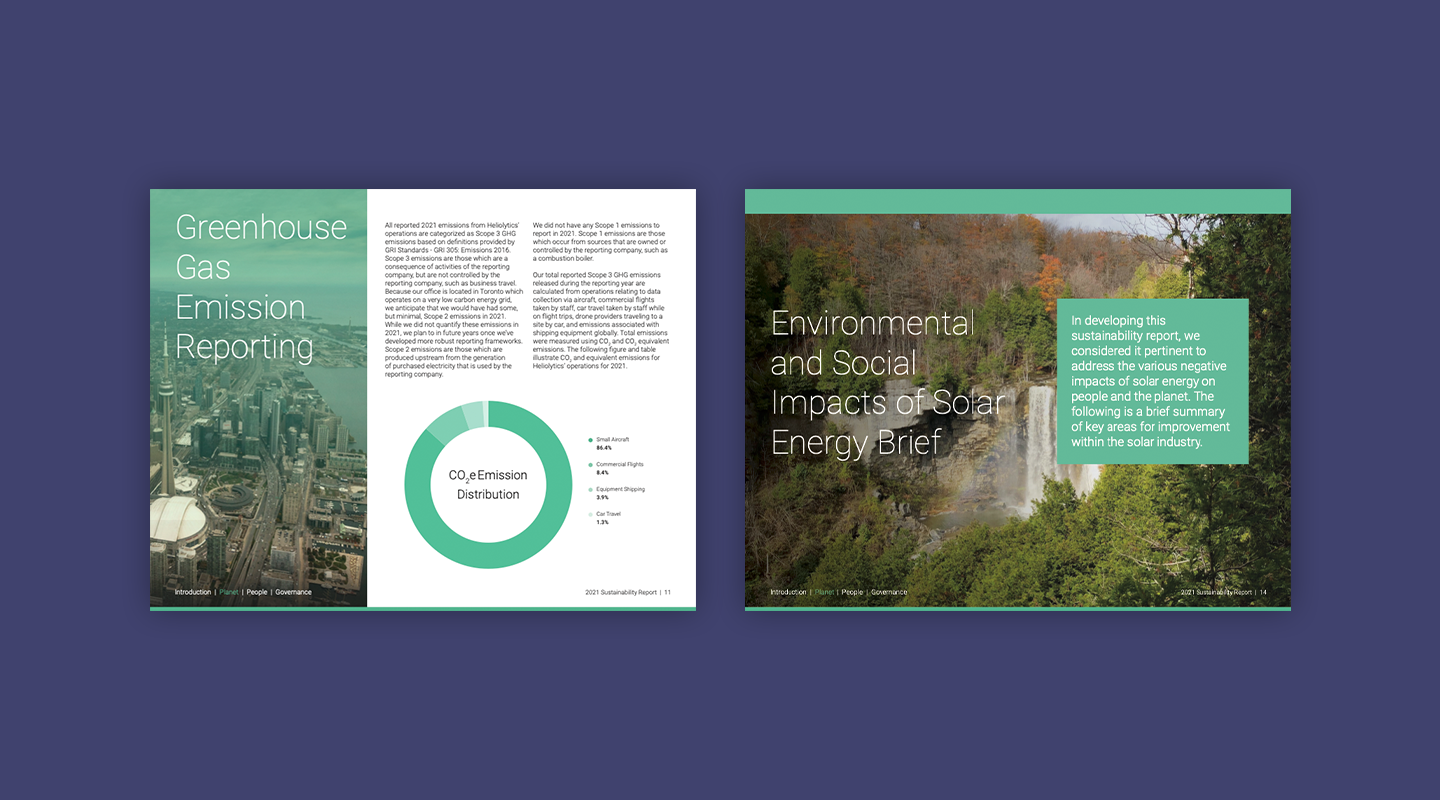

Example: Heliolytics

Heliolytics, a solar energy analytics company, does an excellent job of highlighting its progress and achievements in its ESG reporting. The company regularly tracks and reports on key performance indicators such as energy savings, carbon reductions, and sustainable energy usage. Heliolytics also showcases its innovative technology solutions, such as its data-driven approach to optimizing solar energy production, as a significant contributor to its ESG progress.

The company’s ESG report not only provides stakeholders with a clear understanding of its ESG performance but also emphasizes the positive impact its solutions have on the environment and the wider community. Through its transparent reporting of progress and achievements, Heliolytics demonstrates its commitment to sustainability and the positive impact of its business operations.

Tip #7: Provide Context for ESG Metrics

To effectively communicate the impact of your ESG initiatives, it’s crucial to provide context for the ESG metrics you are reporting on. This can include explaining how the metrics are calculated, how they align with industry standards, and how they demonstrate your company’s commitment to sustainability and responsible governance.

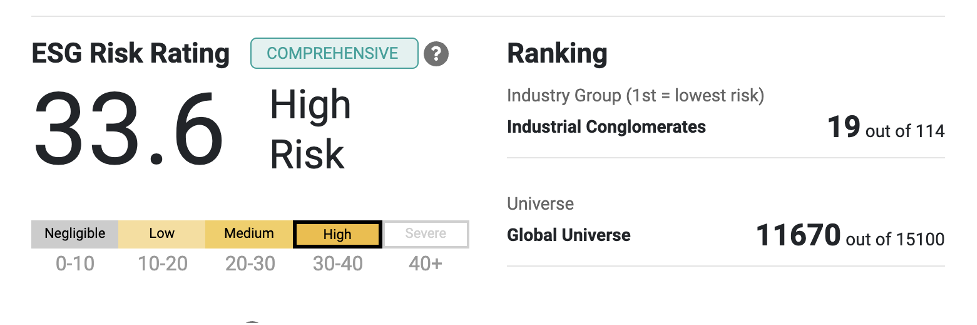

Example: Sustainalytics

Sustainalytics, a sustainable investment research firm based in Amsterdam,

provides context for its ESG metrics in its reporting. Sustainalytics uses its proprietary ESG scores to rate companies based on environmental, social, and governance practices.

In its reports, the company provides detailed information on how it calculates its scores, including a thorough explanation of the methodology and data sources used. This information helps stakeholders understand the context in which Sustainalytics’ ESG scores are generated and provides a more complete picture of a company’s ESG performance. Additionally, Sustainalytics highlights the specific ESG risks and opportunities associated with each company and provides a clear explanation of how these risks and opportunities may impact the company’s long-term sustainability.

By providing context for its ESG metrics, Sustainalytics enhances the transparency and credibility of its research and helps stakeholders make informed investment decisions.

Tip #8: Engage with Stakeholders

Your ESG report should not be a one-way communication. Instead, it should be seen as an opportunity to engage with stakeholders and solicit feedback. This can be done through surveys, focus groups, or other means and can help ensure your report is meeting the needs and expectations of your stakeholders.

Example: QuadReal

QuadReal, a leading Canadian real estate investment company, engages with its stakeholders in multiple ways to ensure its ESG report is aligned with the needs and expectations of its stakeholders. For example, they conduct regular surveys with their tenants to understand their views on environmental sustainability. They also regularly host focus groups with their investors to gather feedback on their ESG performance.

QuadReal also actively encourages its stakeholders to provide feedback and suggestions through its website and annual ESG report. By engaging with its stakeholders, QuadReal can effectively communicate its ESG performance and priorities and make necessary adjustments to meet the evolving needs and expectations of its stakeholders.

Tip #9: Show off your Certifications

Transparency and integrity are key components of successful ESG storytelling and reporting. Your certifications, awards and recognitions validate your efforts and demonstrate your sincerity. These hard-won merits also prove to stakeholders that ESG isn’t merely a tick–the–box exercise for your organization but an ongoing practice with actual results. Bringing your certifications to the forefront will co-sign your approach, demonstrate your commitment to responsible governance and will help build trust with your stakeholders.

Example: B Corp

R&G is certified by B Lab, a non-profit organization. This ensures our trusted partners, clients, and community know we’re transparent about our ESG practices through the B Impact Assessment. The assessment provides a comprehensive evaluation of a company’s ESG impact, including its governance, community, and environmental practices. B Lab also encourages companies to share their assessment results publicly and to take steps to improve their ESG performance.

Tip #10: Be Future-Focused

Your ESG storytelling and reporting may be a snapshot of a moment in time, but you shouldn’t lose sight of your future plans. Your reporting and storytelling should include information on your company’s future ESG goals and how they align with your business strategy.

This can involve setting sustainability goals, tracking progress towards these goals, and regularly reporting on your ESG performance. This will help ensure your company is making its mission visible and sharing real progress in sustainability through responsible governance. It will also help build trust with stakeholders through consistent action.

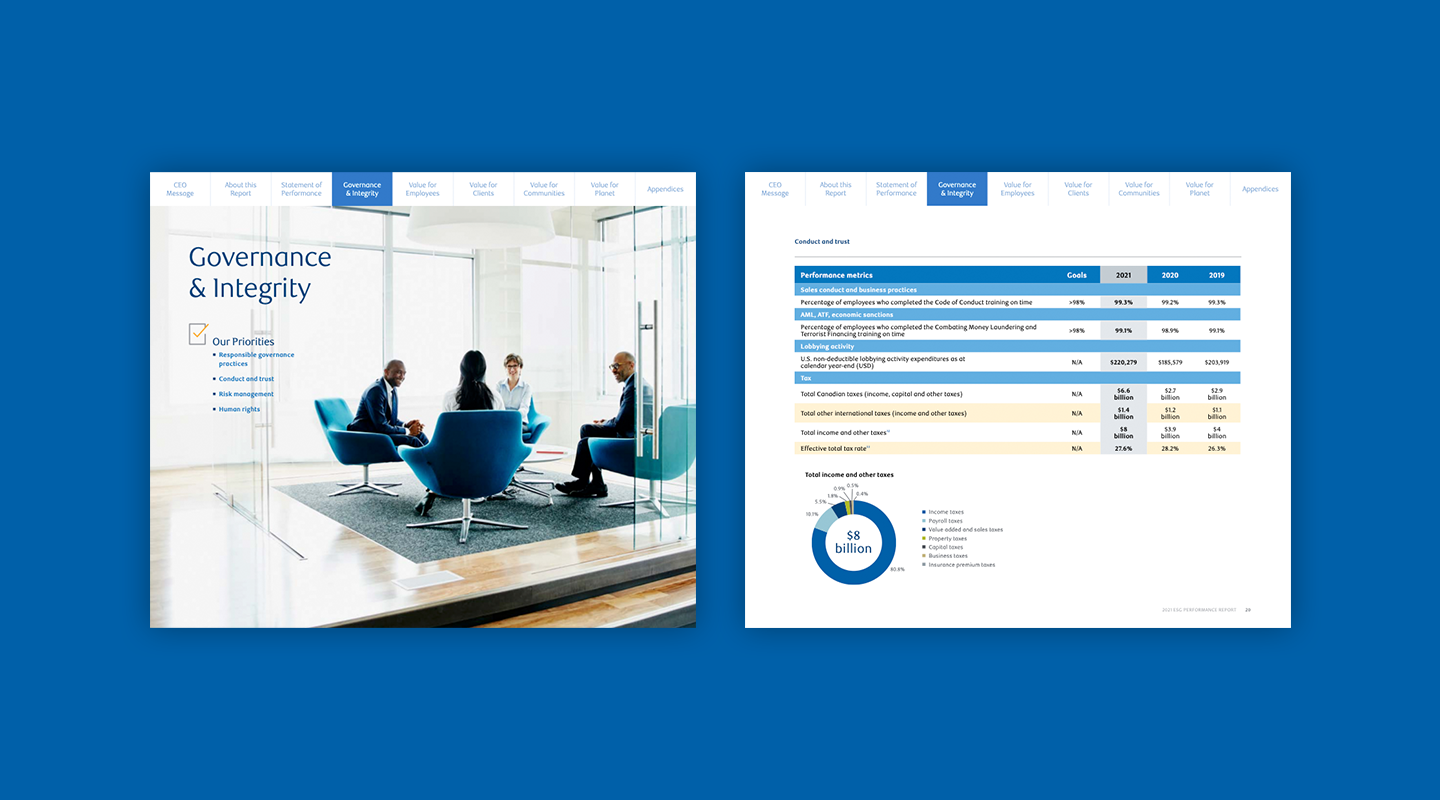

Example: Royal Bank of Canada

In its latest ESG report, the Royal Bank of Canada (RBC) outlines its commitment to sustainability and responsible governance, including its long-term ESG goals and targets. They have set ambitious targets in areas such as carbon emissions reduction, sustainable financing, and diversity and inclusion, tracking their progress toward these goals.

RBC also regularly reports on its ESG performance, including a discussion of its achievements and challenges, highlighting the actions they are taking to address any areas of improvement. This future-focused approach demonstrates RBC’s commitment to sustainability and responsible governance and helps build trust with its stakeholders by showing they’re making progress in these areas.

Make your ESG report design work for you

ESG reporting is becoming increasingly important in the business world, and companies are expected to be more transparent about their sustainability practices. Effective ESG reports serve as a communication tool for companies to showcase their ESG performance and engage with stakeholders. By following these tips and reminders, you can design an ESG report that is effective, engaging and communicates your ESG commitments and achievements.

If you are interested in learning more about crafting an effective ESG report design, or if you would like to speak with an expert about your company’s sustainability and social responsibility initiatives, please reach out to us today for a consultation. Our team of experts is here to help you design and implement an ESG report that effectively communicates your company’s ESG commitments and makes a positive impact in the world.